Trump’s Tax Wishlist: The Estate Tax

Trump’s Tax plan would repeal taxes on multi-million-dollar inheritances

by Chris Thomas

Pictured: the beneficiaries of an estate tax repeal

The centerpiece of the GOP’s 2018 fiscal year calendar is an overhaul of the American tax code. Republicans claim that their reforms will make taxes simpler, reduce the deficit, and deliver tax cuts to all Americans while spurring economic growth to cover the inevitable shortfall in revenues. Critics, and most economists, take a dim view of the plan and GOP’s characterizations of it. In this series we attempt to assess these claims and the criticisms of them fairly and in simple, non-technical language.

Perhaps the biggest item on the Republican tax wishlist is a repeal of the estate tax or “death tax” as the GOP prefers to brand it. Estate taxes are the taxes applied against inherited wealth in any form — land, cash, vehicles, etc.

Who pays the estate tax?

Estate taxes in the United States are complicated, especially when dealing with non-cash assets, but who they apply to is not so complex. A certain amount of every estate in the United States is exempt from taxation and, as a result, only a tiny subset of the American population ever has to pay them.

In 2017 the estate tax exemption was set at $5,490,000.

This means that if your eccentric aunt died and left behind this mansion at 1549 Lindacrest Drive in Beverly Hills you wouldn’t pay a dime in estate taxes. It’s listed on Zillow for $5,395,000 (and appraised for much less).

Pictured: The downtrodden American businessman just trying to get by

The estate tax exemption means that the estate tax is paid, exclusively, by the nation’s financial elite. Repealing it can not, by definition, directly benefit anyone who is not a millionaire or about to become one several times over.

Why does this matter?

For starters, the estate tax raises a lot of money for government programs — about $20 billion dollars a year, or more than enough to cover NASA and the DEA every year. That enormous sum is drawn from just a handful of estates nearly all of which captain corporate empires, hold enormous stock portfolios, or hold vast wealth in some other form. Just 80 of the 5,500 estates subject to the tax in 2017 fall into the categories of farms or small businesses.

And even these 80 can still transfer nearly $5.5 million in assets tax free before any taxes are owed.

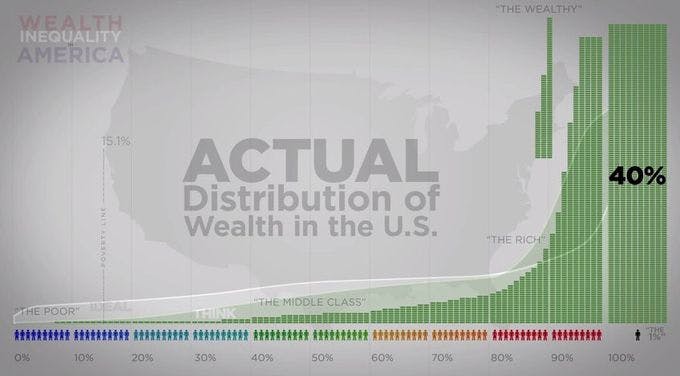

The reason for these staggering numbers is the ever-growing gulf between the wealthy and everyone else in the United States.

Pictured: numbers too different to fit on a chart together

Americans are divided on what that gap actually means and if it constitutes a problem or not. For those that see it as a social or economic injustice, the elimination of the estate tax perpetuates that injustice by further allowing wealth to accumulate in the hands of a financial elite over generations. For those that see it as the fulfillment of the American Dream, however, the estate tax is a grave injustice — pun intended — which robs families of their legacy at their most vulnerable time.

Tell Congress what you think!

Taxes will be a subject on ongoing debate in Congress for quite some time but it’s never too early to make your opinion known. Text RESIST to 50409 to tell your representatives or Senators what you think about this or any other issue before Congress.

More On Taxation

Support the ’bot!

Upgrade to premium for AI-writing, daily front pages, a custom keyword, and tons of features for members only. Or buy one-time coins to upgrade your deliveries to fax or postal mail, or to promote campaigns you care about!

Upgrade to PremiumBuy Coins