Pay As You Go

Two things in life are certain: PayGo and Taxes

by Chris Thomas

Photo by Alice Pasqual

A long, long time ago in the 1990s, back when Republicans cared about deficits and fiscal responsibility, President George H.W. Bush negotiated and signed a deficit reduction package. One provision of this package was a law called “PayGo.” PayGo was meant to enforce budget discipline. Any law, passed by Congress, that increased the deficit over either a 5 or 10 year period required either a separate vote to waive/circumvent PayGo or mandatory, across-the-board budget cuts to a wide range of government services from Farm Price Supports to Medicare.

The Trump Corporate Tax Cut is no exception.

At this point it’s fairly clear that the TCTC is going to pass and that the bill will tack a trillion-and-a-half dollars onto the federal deficit over the next few years. That will trigger PayGo which will, in turn, constitute the next big hurdle that the TCTC has to clear.

How’s This Work?

PayGo assesses Congressional spending at the end of the year and institutes mandatory budget cuts — sequestration — in the following year. So, if President Trump signs the TCTC in December, the Office of Management and Budget will assess Congress’ 2017 session as adding $1,500,000,000,000 to the deficit over the next decade and sequestration will kick in for 2018.

But, if Trump signs the TCTC in January of 2018, those cuts won’t come into force until 2019. Trump can delay these cuts but not avoid them. Congress could avoid the sequestration cuts by either voting to waive the PayGo rules for the TCTC or by manipulating the way the OMB does its accounting (which amounts to the same thing) but either of those options mean passing another bill and that means getting something through the Senate and surviving the threat of a Democratic filibuster.

And filibuster they (probably) will. In a letter to House Speaker Paul Ryan (R-WI), House Democrats threw down the gauntlet on PayGo:

The irresponsible tax cuts you are pursuing will explode the federal deficit, violating the principle, enshrined in the 2010 Statutory PAYGO law, that tax cuts should be paid for. Under that law, your unpaid-for tax cuts, if enacted, will trigger automatic, across-the board cuts to Medicare, the farm safety net and other programs. Given the lack of bipartisanship to date in your effort to provide massive tax cuts to the wealthy at the expense of the middle class while adding $1.5 trillion to the deficit, it will be your responsibility to deal with these consequences.

If Democrats stand firm and insist that the Republicans reep the fiscal whirlwind they sewed with a trillion-and-a-half dollar, deficit-financed, corporate tax cut, sequestration will happen either in 2018 or 2019.

What Gets Cut?

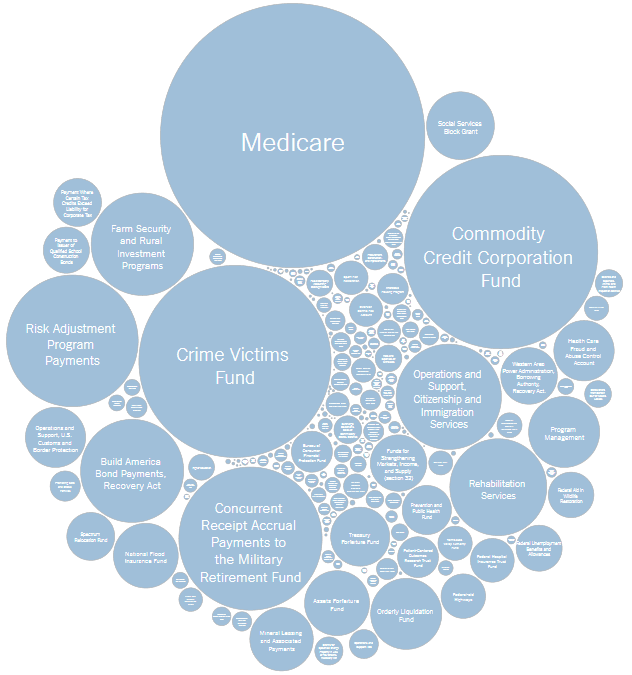

The list of programs on the chopping block for PayGo sequestration is long and painful.

Image via New York Times

Notably not on the sequestration list are Social Security, Medicaid, the Post Office, Supplemental Nutrition Assistance Program (SNAP — or Food Stamps), Unemployment Insurance, and a few others. Notably on the list is Medicare with more than a half-a-trillion dollars of its funding subject to sequestration cuts.

How Much?

The PayGo law actually caps the amount that can be cut from Medicare at about 4% of Medicare’s current spending. That puts a $26 billion dollar target on America’s retirees but that’s not nearly enough to make up the costs of the TCTC. Ten years of $26 billion in Medicare cuts only adds up to $260 billion dollars. The TCTC adds $1,500 billion ($1.5 trillion) to the deficit. The other $1.2 trillion — about $124 billion a year — has to come from somewhere.

And that somewhere is literally every other program on the sequestration list. For many of them, the amount subject to sequestration constitutes the entirety of their budget. Some highlights from the chopping block:

- Farm price-support programs: $13.7 billion a year. Gone.

- National flood insurance fund: $1.5 billion a year. Gone.

- DHS Travel Authorization System: $62 million a year. Gone.

- VA retirement fund for disabled vets: $7.5 billion a year. Gone.

- DHS Citizenship and Immigration Services: $4 billion a year. Gone.

- Presidential Election Campaign Fund: $50 million a year. Gone.

- United States Holocaust Memorial Museum: $48 million a year. Gone.

- US Customs and Border Protection: $1.3 billion a year. Gone.

In total, more than 200 government agencies from the Department of Agriculture to the Treasury face deep cuts to vital programs. This is not a governmental shutdown in which Washington DC stays home for a few days while Congress and the White House spit at each other on national television. These cuts represent a massive scaling back of major economic commitments made by the US government. The consequences will be huge, catastrophic, and long-lasting.

Tell Congress what you think!

With the GOP’s corporate tax cut polling in the low 30s, Democrats think they have a winning issue in refusing to waive the PayGo rules for the rushed, unpopular cuts. Republicans, meanwhile, assume the cuts will be too painful for the Democrats to stomach.

Text RESIST to 50409 to tell your representatives or Senators what you think about this or any other issue before Congress or use Facebook messenger to do the same thing by clicking here.

More On Taxes

Want to learn more about the Trump’s corporate tax cut and how it’ll affect you? We’ve got you covered.

Support the ’bot!

Upgrade to premium for AI-writing, daily front pages, a custom keyword, and tons of features for members only. Or buy one-time coins to upgrade your deliveries to fax or postal mail, or to promote campaigns you care about!

Upgrade to PremiumBuy Coins